How to Identify and Avoid Tax Scams

Tax scams have been a costly nuisance for taxpayers and the IRS for many years. Over the last few tax seasons, there have been more and more reports of scams and people falling prey to them. The more lines of communication that become available, the more ways scammers have to try to access your information.

Taxpayers are urged to stay alert of these potential scams to avoid losing your money or being a victim of identity theft.

Share This Image On Your Site by Using the Code Below.

</p><br /><br /> <p><a href=’ http://www.bssf.com/blog/identify-avoid-tax-scams/ ‘><img src=’http://www.bssf.com/wp-content/uploads/2017/02/Tax-Scam-Infographic.png’ alt=’2016 Tax Scams & How to Avoid Them in 2017′ width=’800px’ border=’0′ /></a></p><br /><br /> <p>

What Are the Most Popular Tax Scams?

Email and Phishing Taxpayer Scams

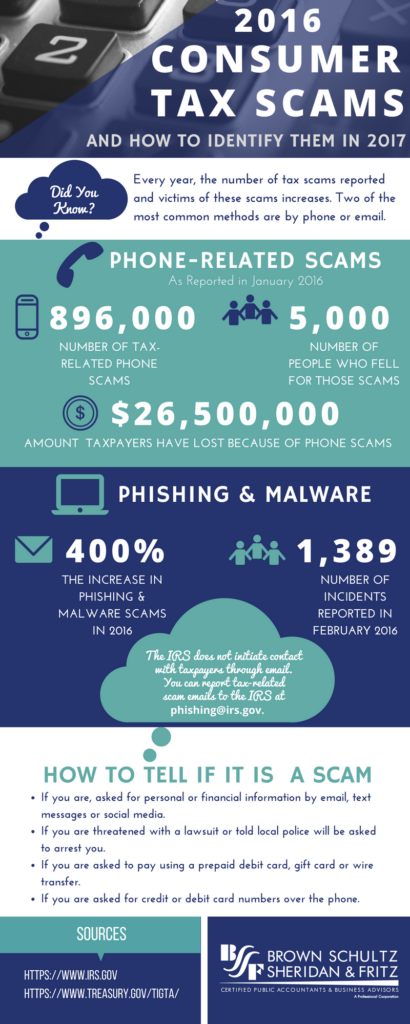

The IRS has provided the public with several alerts about email phishers who are using the IRS logo and name in digital communications. The scammers will try to gain access to personal and financial information through these emails. In 2016, the IRS reported a 400% increase in phishing and malware incidents, and in February 2016, before tax season was over, they had 1,389 reported incidents, an increase in the same period from 2015.

The IRS will never initiate contact with you through email, text message or social media to request any of your personal or financial information.

Phone Scams

In 2016, the Treasury Inspector General for Tax Administration (TIGTA) said they received approximately 896,000 reports of tax-related phone scams since October 2013 and confirmed that over 5,000 victims have paid over $26.5 million because of these scams.

One of the most wide reaching scams involves fraudulent phone calls. The scammer will aggressively call taxpayers on the phone. During the communication, they will claim to be employees of the IRS and demand immediate payment. They may give a fake IRS ID badge number and can alter their phones so the caller ID will say IRS. They will be prepared with some of your basic information in order to convince you of their authenticity.

Keep in mind that the IRS will never demand immediate payment from a taxpayer over the phone; this is ALWAYS a fraudulent request. You would receive a mailed communication from them regarding money owed.

Scams Using Text Messages

Phishers are also using text to try to fool taxpayers into giving up money or personal information. These texts will seem innocuous and quick, asking a simple question and promising a benefit such as a quicker turnaround on your return. They may say that you did not enter a bit of information into your tax forms correctly – something important such as your SSN or bank account number.

The IRS does not use text for any official communication. Be wary of giving away any information via text, especially if you receive that communication from a blocked number.

Taxpayer Advocacy

Tax scammers will also pose as members of a Taxpayer Advocacy Panel (TAP) in order to get information. These emails are the same type of scam as phishing scams using fake IRS badge numbers and emails. You must be sure not to click any of the links in these emails; as a matter fact, you should not even open them. TAP is an advisory panel for the IRS and will never request any of your personal or financial information, nor do they have access to this information.

How to Avoid Falling for Scams

When it comes to tax scams, taxpayers should always pay close attention to any communication they are receiving. To avoid falling into one of the scams, be aware of the warning signs.

The IRS will not:

- ask for personal or financial information via text, email communications or social media.

- threaten you with a lawsuit or tell you that local authorities will be asked to arrest you.

- request that you make payments with a prepaid debit card, gift card or wire transfer.

- ask for your credit card or debit card number over the telephone – you would receive some sort of mailed communication.

If you receive an email requesting any of the above, you can report it to the IRS by forwarding the email to phishing@irs.gov.

For additional ways to report these communications, visit https://www.irs.gov/uac/report-phishing.